Are you looking for the Best Bitcoin Casinos? Confused to pick the right online crypto gambling site, DON’T WORRY. I am here to help you out.

I am Abishai James, a Crypto Gambling lover and I’ve been in this industry for a decade. I have tested some 100s of crypto gambling sites online, and I want to share all my experience and love towards crypto gambling on this site.

Today, it’s not that easy to find the Best Bitcoin Casino that is trustworthy and legitimate, ensuring profitable gambling experience for all their players. Some of the illegal crypto casinos simply take away money from players, freeze their casino accounts, and don’t respond to player’s requests. Don’t worry, I will try to list some Best Crypto Gambling Sites here based on security, quick payouts, bonuses and promotions, best games like – blackjack, poker, baccarat, roulette, slots, bingo, dice games etc., support and more. Players can blindly sign up with the casinos listed on our site and enjoy profitable online crypto gambling experience.

In my research, I found BC.Game as the Best Crypto Gambling Platform that has everything required for the players, also ensuring top-notch crypto gambling experience.

Best Bitcoin Casinos (Highly Recommended) – (Updated 2023)

- Perks for VIP members

- Accepts Multiple Cryptocurrencies

- Immersive Public Chat

Free Crypto - $1 - $3 on Sign Up

240% Bonus

Spin & Win up to 1BTC everyday.

- 1000+ casino games

- Offers sports betting

- Quick Support

Welcome Bonus

5 BTC

300 Free Spins

- No minimum deposit

- Easy Payments

- Friendly support

EXCLUSIVE

177% Bonus + 77 FREE SPINS

- Easy Withdrawals

- Great Promotions and bonuses

- Top-notch site security

6 BTC (or) 1200 USD

- Highest casino limits

- Instant payouts

- Resolved Complaints

100% Up To

5 BTC

80 Free Spins

Players can find a BIG LIST (70 Best Bitcoin Casinos) of Trustworthy Online Crypto Casinos here.

(1) BC.Game Casino

Special Bonus

Welcome Bonus:- Signup & Get Reward up to $2000

1st deposit:- With your first deposit you can receive a 180% bonus!

2nd deposit:– With your second deposit you can receive a 240% bonus!

3rd deposit:– With your third deposit you can receive a 300% bonus!

4th deposit:- With your fourth deposit you can receive a 360% bonus!

Register, Claim Bonus & Play Now

Bc.Game is a well known crypto gambling platform since 2017. The casino is owned and operated by BlockDance B.V. The casino is fully encrypted with blockchain technology. If you’re new to crypto the casino gives detailed information in regard to crypto gambling and buying crypto. The casino is well approved by iTech labs and supports provably fair technology. The casino is mobile friendly too. You can register on smartphones, Laptops and tablets if you prefer Mobile Casino. It accepts more than 20 Cryptocurrency along with fiat currency.

Pros

Available in 10+ languages

Accepts 20 + cryptocurrency with fiat currency.

Mobile Friendly

Wide range Casino games

Attractive Bonuses

Bet on more than 80 Sports

24/7 Support team

Cons

Deposits takes time

High Wagering requirement

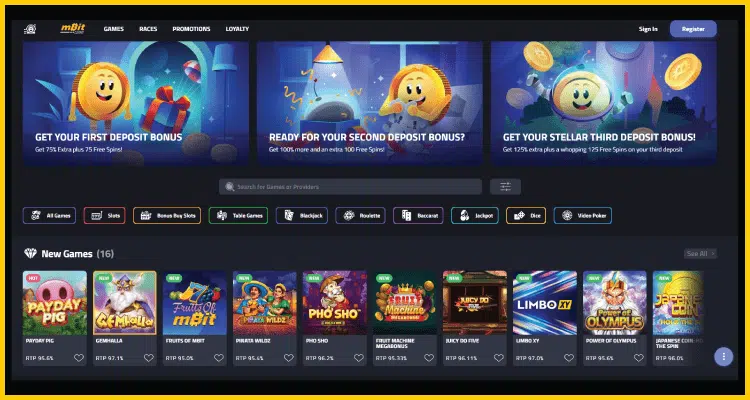

(2) mBit Casino

Special Bonus

1st deposit:- Get 75% bonus up to 1 BTC with 75 free spins.

2nd deposit:– Get 100% bonus up to 1.5 BTC with 100 free spins.

3rd deposit:– Get 125% bonus up to 1.5 BTC with 100 free spins.

Register, Claim Bonus & Play Now

Mbit casino has been one of the leading online casino since 2014. The casino is operated and owned by Direx N.V and registered under the laws of Curacao government. The casino provides ultimate entertainment to all its players with amazing rewards and offers. The casino provides simple , fast and safe transactions with cryptocurrency. The customer support is available around the clock to guide in all the aspects. The casino is mobile friendly and available on both Android and iOS. Sign Up Now for more and more fun.

Pros

2000+ casino games

Mobile Friendly

Exclusive bonuses with rewards

Safe and Secure platform with encrypted techniques

24/7 Support team

cryptocurrency with fiat currency is accepted

Provably Fair Games

Cons

Restricted in more number of countries

Sports Betting is not available

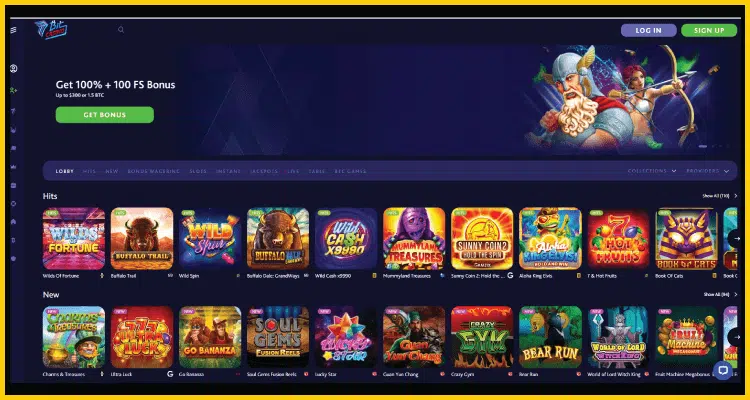

(3) 7Bit Casino

Special Bonus

1st deposit:- 100% Bonus up to $300 or 1.5 BTC + 100 FS

2nd deposit:– 50% Bonus up to $400 or 1.25 BTC +50 FS

3rd deposit:– 50% Bonus up to $800 or 1.25 BTC

4th deposit:- 100% Bonus up to $3500 or 1 BTC

Register, Claim Bonus & Play Now

7Bit Casino has been one of the most trusted online gambling casino since 2014. The casino is operated and owned by Dama N.V and registered under the laws of Curacao government. They have been in the iGaming industry for many years and can prove their reliability with a solid license. 7Bit Casino offers the widest range of Bitcoin casino games (7000+) to suit all tastes: slots, Bitcoin table games, video poker, live entertainment and many more.

They offer fastest payouts in a wide range of cryptocurrencies along with fiat money. Join 7Bit and play Best Bitcoin casino games with BTC to win big!

Pros

Simple Registration

Generous Welcomepacks

Attractive Bonuses

Wide range of e-currencies

VIP membership

Excellent tournaments

Dedicated Support Team

Cons

Low withdrawal limits

Processing fees for withdrawals

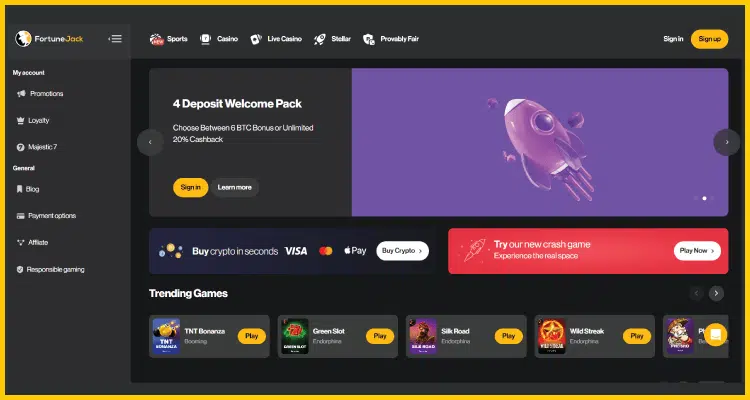

(4) Fortunejack Casino

Special Bonus

1st deposit:- 110% Deposit Bonus + 250 Free Spins

2nd deposit:– 100% Deposit Bonus + 100 Free Spins

3rd deposit:– 100% Deposit Bonus up to 1.5 BTC

4th deposit:- 100% Deposit Bonus up to 1.5 BTC

Register, Claim Bonus & Play Now

Fortunejack Casino has been one of the most advanced crypto gambling casino since 2014. The casino is operated and owned by Nexus Group Enterprises N.V and registered under the laws of Curacao government. The casino provides safe, fast, engaging and entertainment to all its players with varieties of games and payment options. The customer support is available around the clock to guide in all the aspects. You can reach them here :- support@fortunejack.com The casino is mobile friendly and available on both Android and iOS. Sign Up Now for more and more fun.

Pros

Simple Registration

Attractive Bonuses

Top software developers support

Quick withdrawals

Wide range of cryptocurrency accepted

Dedicated Support Team

Cons

Available only in English

No fiat currency support

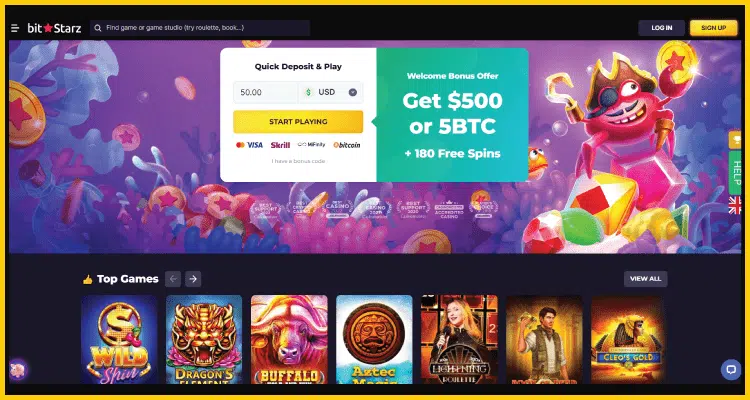

(5) Bitstarz Casino

Special Bonus

1st deposit:- 100% up to $100 or 1 BTC + 180 Free Spins

2nd deposit:– 50% up to $100 or 1 BTC

3rd deposit:– 50% up to $200 or 2 BTC

4th deposit:- 100% up to $100 or 1 BTC

Register, Claim Bonus & Play Now

Bitstarz was the first multi currency online casino to offer international currency as well since 2014. The casino is operated and owned by Dama N.V and registered under the E gaming license of Curacao government. It is their customer-first attitude that made them impress gamers around the world. Offering an all-in-one experience complete with thousands of the best games and 24/7 customer support, no gamer is left behind when they join BitStarz.

They always say “Dream big, make a lot of money”, you can be sure you are safe.

Pros

Excellent selection of casino games

Easy-to-use interface

Fast payouts

Excellent User-interface

4000 + games

Generous bonuses

Demo version is also available

Cons

No Sports Betting option

Many countries are restricted

Processing fees for few mode of payments

(6) Cloudbet Casino

Special Bonus

Welcome Bonus : Get up to 5 BTC

Register, Claim Bonus & Play Now

Cloudbet was the first Top rated crypto casino site and sportsbook since 2013 2013 in Montenegro and the casino rights are reserved under the company Halcyon Super Holdings B.V. The casino accepts a wide range of cryptocurrency with outstanding bonuses. Bet safe with Cloudbet you can take advantage of 2FA account security, crypto privacy, and a dedicated, 24/7 customer service team. Online gaming has never been more secure. Start betting with a top class crypto gambling casino now!

Pros

Massive Welcome bonus

Mobile-friendly.

Fast Withdrawals.

2FA Privacy and Security

Bitcoin sportsbook is available.

Wide range of games

Generous Bonuses and free spins

Cons

Fiat currency is not accepted

Restricted in many countries

Lack of Mobile app

(7) TrustDice Casino

Special Bonus

1st deposit:- 100% up to $30,000 / 1 BTC + 25 FREE SPINS

2nd deposit:– 75% up to $30,000 / 1 BTC

3rd deposit:– 50% up to $30,000 / 1 BTC

TrustDice is a proven fair game platform based on blockchain technology that offers a selection of games in the crypto casino world. Trust is extremely important to TrustDice and it is also important to all the crypto lovers.. TrustDice crypto casino games run on proven blockchain technology – you no longer need to trust the bookie to offer fair odds.

TrustDice.win is one of the best bitcoin casino sites. It is a completely fair gaming platform based on blockchain technology, which means all transactions at the casino are verifiable. Thus, it gives players much-needed peace of mind.

Pros

Mind Blowing Bonuses

Flash like customer support

Zero Withdrawals fees

2000+ Bitcoin casino games

Provably fair games

24/7 Support team availability

Associated with top software providers

Cons

Wagering issues

(8) Bitsler Casino

Special Bonus

100% Welcome Offer to Sportsbook and Casino up to $700

Casino Sports Esports Live Bitsler Welcome Bonus – Get 100% matched deposit bonus up to $700

Bitsler is an online crypto gambling site founded in 2015. You can play classic casino games like slots, roulette and blackjack. Or real crypto games like Dice and their very own crash game: Blast! In total, they have 21 homemade casino games with automatic bets and proven fair features to ensure a great gaming experience! They also have a bookmaker where you can bet on all your favorite sports games. You can gamble with more than 20 cryptocurrency. They give away millions as promotions every year. Join now!

Pros

Bet on all sports with crypto

Super Duper customer support

Great games with huge promotions

Bet on all esports with crypto

Provably fair games

24/7 Support team availability

Associated with top software providers

Cons

Design and interface is not attractive

No live chat for unregistered players

(9) BetAndYou Casino

Special Bonus

1st deposit – 100% bonus and 30 FS

2nd deposit – 50% bonus and 35 FS

3rd deposit – 25% bonus and 40 FS

4th deposit – 25% bonus and 45 FS

Betandyou offers their services to its online bettors. The company has successfully been owned and operating in the Central Asia market since 2010 under a license issued by the Netherlands Antilles Government (Curacao).

Betandyou offers a wide range of bonuses and promotions including a 100% welcome bonus of 110 Euro. New customers can take advantage of their simple registration process in order to save time and focus on your favorite events. Customers who want to place online bets on sports events can also register on the desktop and mobile version of their site.

Pros

High odds

Wide selection of pre-match and live bets

Fast payouts

Wide range of bonuses and promotions

One click registration

Bet settlement

24/7 professional customer support team

Cons

Slow withdrawals

Average response time is 2 days

(10) Lasamericas Casino

Special Bonus

First deposit – 100% up to €150 + 50FS. Use this code: AMERICAS1

Second deposit – 50% up to €100 + 50FS. Use this code: AMERICAS2

Lasamericas casino offers a wide range of online casino games with a crypto friendly environment. The casino fulfills all the customer needs in regard to online casino games. They also have a qualified customer support team. The casino holds a license under laws of the Curacao government. The license covers online casino, sports and live casino. Lasamerica strives to provide a safe and secure gaming environment.

Pros

Attractive Welcome bonus

Mobile-friendly.

24/7 Support team availability

Associated with top software providers

Fast Cashouts

Simple registration

Cons

Restricted in many countries

Available in only 3 languages

Regular promotions are not always available

(11) Will’s Casino

Special Bonus

First deposit – 100% up to €200 + 50 Free spins Code 100%: WILL1

Second deposit – 50% up to €150 + 50 Free spins Code 50%: WILL2

Will’s Casino offers a great selection of games along with live casino games in a user friendly environment. The casino is operated and owned by Mirage Corporation N.V. and registered under the laws of Curacao government. The casino has a dedicated and qualified support team and they fulfill all your individual queries in very less time. The casino has a one-wallet-solution that allows all your transactions to be safe and secure under SSL encryption techniques.

Pros

Associated with top software providers

Fast Cashouts

Simple registration

Cryptocurrency is accepted along with fiat currency

Mobile-friendly.

24/7 Support team availability

Cons

Restricted in many countries

Live Chat not available

(12) 777Bay Casino

Special Bonus

1st deposit – 125% matching bonus of up to 1,500 €/$

2nd deposit – 50% up to 1,500 €/$ and 50 free spins

3rd deposit – 75% up to 1,500 €/$ and 75 free spins

777Bay prides itself on taking care of its players. The casino provides a high quality gaming experience for all your gaming needs – slots, online casinos, sports betting and more. All under one roof in a safe and friendly gaming environment. The casino has a professional team who has long run experience in the gaming industry. You have an award winning customer support team available around the clock. The casino is mobile friendly and available on Android and iOS devices. All the transactions are simple as they offer a wide range of payment methods. The transaction is secure under SSL security.

Pros

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

High security and safety

Well licensed casino

Mobile-friendly.

24/7 Support team availability

Cons

Restricted in many countries

Interface issues

(13) VipSlot.Club

Special Bonus

Deposit 1 – 200% Bonus up to $500.

Deposit 2 – 200% Bonus up to $500.

Deposit 3 – 200% Bonus up to $500.

CRYPTO BONUS :- GET 300% CASH ON 3 CRYPTO DEPOSITS

VipSlot.club offers players only the best online games available and an unforgettable gaming experience at Live Casino, so you are guaranteed to be entertained to the fullest.

The casino offers over 3,100 online games including slots, roulette, blackjack and more. Their goal is to partner with the best gaming software companies in the industry.

Vipslot.club has been operated by InterAlliance since 2021. Each of their games has been checked, approved Officially approved and certified to ensure that they are fair to all players.

Pros

Associated with top software providers

Multilingual customer support

Cryptocurrency is accepted along with fiat currency

High security and safety

Attractive bonuses

Mobile-friendly.

Cons

Restricted in many countries

Wagering issues

(14) The ClubHouse Casino

Special Bonus

Welcome Bonus :- Get 100% bonus up to ₹20,000

CRYPTO BONUS:- Get up to 0.5 BTC + 150 free spins

The Club House Casino certainly looks promising in terms of what it offers its customers. New entrants can reap the rewards of the welcome offer while more active players can look forward to one of the many offers along with an extensive library of games. The casino is operated and owned by Dama N.V and registered under the laws of Curacao government. The casino can be operated via Mobile through a browser.

Pros

Associated with top software providers

24/7 Support team availability

Live dealer games

Multilingual customer support

Multiple payment options

High security and safety

Attractive bonuses

Mobile-friendly.

Cons

Restricted in many countries

No proper loyalty program

No Mobile application

(15) N1 Bet Casino

Special Bonus

1st deposit – 20% NORISK FREE BET UP TO 200 EUR + 300% Hunting Bonus up to 5 000 EUR

2nd deposit – 15% ONLY WIN FREE BET UP TO 150 EUR + 25% Express bonus

3rd deposit – 20% ONLY WIN FREE BET UP TO 200 EUR +100% Hunting up to 1 000 EUR

4th deposit – 15% ALL WIN FREE BET UP TO 100 EUR + 50 EUR AllWin free bet for 500+ EUR deposit.

Betting company N1 provides online betting services for dozens of sporting, e-sports, political and non-sports events. Each of their players can count on fast payouts, attractive bonuses and high coefficients. They are ready to be your bookmaker. And it doesn’t matter what you bet on – World Cup or International in Dota 2. The casino is operated and owned by Dama N.V and registered under the laws of Curacao government since 2021. All the transactional data is protected under SSL encryption.

Pros

Profitable Bonuses

Bet on Popular Sports and esports

Loyalty to Players

Safety and Security

Wide range of payment options

Fantastic Support team

Cons

No Attractive bonuses

Restricted in many countries

No Sports Betting option

Many countries are restricted

Processing fees for few mode of payments

(16) WinLegends Casino

Special Bonus

Welcome Bonus: Get up to a 300% bonus of up to €550 and 300 free spins

WinLegends Casino operated and operated by Altacore NV. It is a new online crypto casino in 2022. It offers a fun and unique platform where you can choose a hero to represent yourself. When you sign up, you choose your hero, and each hero has a unique welcome bonus they give you. The casino offers more than 4000 casino games for you to have ultimate fun and best gaming experience with popular payment methods.

Pros

Attractive Bonuses

24/7 support team availability

Popular payment options

4000+ casino games

Amazing mid week bonuses

Loyalty program

Mobile friendly

Safety and Security

Cons

Restricted in many countries

(17) CrocoSlots Casino

Special Bonus

1st deposit – 100% bonus €1000 + 100 Free spins Bonus-Code: CS1

2nd deposit – 75% Bonus €1000 + 75 Free spins Bonus-Code: CS2

3rd deposit – 50% Bonus €1000 + 50 Free spins Bonus-Code: CS3

At CrocoSlots Casino, they feel your desire for a wild gaming experience in a completely safe and secure environment. The casino made this a reality through a combination of wildlife themes and cutting-edge technology. From the moment you enter the world of CrocoSlots, you can enjoy extraordinary offers, various games and 24/7 support. They also know what you value most: fast withdrawals, great bonuses and exciting tournaments, and it’s all waiting for you!

Pros

Great Bonuses

24/7 support team availability

Exciting Tournaments

Fast money withdrawals

VIP program

Mobile friendly

Safety and Security

Cons

Restricted in many countries

Few modes of withdrawals

(18) Treasure Spins Casino

Special Bonus

Welcome Casino Bonus – 130% up to 500$

Welcome Live Casino Bonus – 100% up to 200$

Welcome Sports Bonus – 100% up to 100$

Treasure Spins is one of the newest additions to the online casino scene, and it promises to deliver an ultimate fun and unique gaming experience. In addition, Treasure Spins Casino is owned and operated by CW Marketing B.V., in the year 2022 a company registered in Curacao.

In addition, the casino is managed by a team of experienced professionals in the industry who have designed the casino to suit the needs of the players. The casino also offers a variety of games, including slots, blackjack, roulette, and more. You can simply register and start experiencing fun full entertainment.

Pros

Tons of games

Associated with top software providers

24/7 support team availability

Cryptocurrency is accepted along with fiat currency

Multilingual customer support

Exclusive offers and rewards

Cons

Restricted in many countries

Limited Live chat hours

(19) Casinozer

Special Bonus

Welcome Sports Bonus: Freebet up to €50

Welcome Bonus for Casino Live Casino For your first deposit: €20 of Free spins

Casinozer offers players only the best online games available and an unforgettable gaming experience at a Live Casino, so you are guaranteed to be entertained to the fullest. The casino offers over 3,100 online games including slots, roulette, blackjack and more.

Casinozer.com is operated by Altacore N.V., a company registered and incorporated under the laws of Curacao. Each of these games has been officially tested, approved and certified to ensure that they are fair to all players.

Pros

24/7 support team availability

Popular payment options

Mobile friendly

Safety and Security

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

Cons

Restricted in many countries

Limited Bonuses

(20) Tournaverse Casino

Special Bonus

Welcome bonus :- 100% UP TO €777

Tournaverse promises to deliver premium entertainment in the safest and most secure environment possible for everyone. Player trust, transparency, fast, secure payments and timely attention to all the needs of their valued members, are the basic principles on which Tournaverse will always operate and respect.

The casino deck team is always ready to assist you in any way possible. You can reach them by filling out the contact form, by email: support@tournaverse.com or via live chat, 365 days a year!

Pros

Tons of games

Associated with top software providers

24/7 support team availability

Sportsbook

Perfect design for the game

Cryptocurrency is accepted along with fiat currency

Exclusive offers and rewards

Cons

Restricted in many countries

Limited Live chat hours

Low Withdrawal limits

(21) Bruno Casino

Special Bonus

1st deposit – 100% up to €100 + 250 Free Spins

2nd deposit – 55% up to €100

3rd deposit – 100% up to €100

Bruno Casino is the next generation high-tech casino with the latest games developed by the best professionals in the industry. They have played at many different online casinos over the years. The casino has accumulated huge gaming experience. They know what a real gamer needs. The casino is well licensed and offers more than 6000 online casino games from top software providers.

Pros

Associated with top software providers

Stunning Graphics

6000+ casino games

24/7 support team availability

Prompt Payouts

Licensed casino

Attractive Bonuses

Cons

Restricted in many countries

Limited payment modes

(22) Chipstars Casino

Special Bonus

1st deposit – max 1800 € UP TO 200% BONUS

2nd deposit – max 4410 € UP TO 210% BONUS

3rd deposit – max 9460 € UP TO 220% BONUS

4th deposit – max 20790 € UP TO 270% BONUS

Chipstars is your best online poker, casino and sports betting platform! Behind Chipstars is a young team that strives to bring the beliefs of poker, casino and sports betting closer to you through user experience. Chipstars is a one-of-a-kind place where you can go from sports betting to casino and back to poker or try your luck with eSports, it’s never been an easier position! The greatest strength and ultimate goal of their company is to introduce safe and innovative methods in the iGaming environment.

Pros

Fast Payouts

Multiple Crypto currency

Safety and Security

Responsible Gaming

Attractive Bonuses

24/7 support team availability

Cons

Limited Payment methods

(23) Drift Casino

Special Bonus

Welcome bonus – 100% bonus up to €500 on the first deposit + 50 free spins

Drift Casino is a beautifully designed racing-inspired gaming site, operated under license from Curacao. The operator launched multiple software platforms in 2016. Existing casino-style slots and table games are powered by industry leading developers.

Games run on browser-based platforms, with the ability to play on smartphones, tablets, and desktop computers. Drift Casino has an exceptional banking system with many secure deposit and withdrawal options in 5 currencies. Players will also benefit from top-notch customer support and simple promotional terms. All these aspects make Drift a great place to play your favorite casino games.

Pros

Multilingual website

Mobile friendly

Amazing bonuses

Outstanding games from top providers

24/7 support team availability

Cons

Restricted in many countries

(24) Igu casino

Special Bonus

1st deposit – 100% UP TO €300 + 100 FS in the game Jungle Stripes. Bonus Code: IGU100

2nd deposit – 75% up to €100 + 50 FS Aztec Magic (BGaming) Bonus Code: IGU75

3rd deposit – 50% up to €150 + 30 FS Lost Mystery Chests (Betsoft) Bonus Code: IGU50

Igu casino is the best casino which has every player’s taste. The casino is operated and owned by Dama N.V and registered under the laws of Curacao government. Igucasino presents a collection of fun games from the best software developers that you can play for real money or try game bitcoin casino demos on their website. There are generous rates and special offers, a user-friendly interface, responsive customer support, and many other attractive options that will make your stay safe and enjoyable.

Pros

Multiple Payment options’

Mobile friendly

Amazing bonuses

Cryptocurrency is accepted along with fiat currency

3000+ quality games

24/7 support team availability

Cons

Restricted in many countries

(25) Oxi.Casino

Special Bonus

Welcome Bonus :- 100% Deposit Bonus up to €100

Oxi.Casino offers players only the best online games available and an unforgettable gaming experience at the Live Casino, so you are guaranteed to have maximum fun.

The casino offers over 3,100 online games including slots, roulette, blackjack and more. The casino is operated by Altacore N.V., a company registered and incorporated under the laws of Curacao. Each of their games has been officially tested, approved and certified to ensure that they are fair to all players.

Pros

Associated with top software providers

24/7 support team availability

Mobile friendly

Huge collection of games

Cryptocurrency is accepted along with fiat currency

Amazing bonuses

Cons

Restricted in many countries

(26) Casino Bull

Special Bonus

Welcome Bonus :- Get 25 Free Spins

Casino Bull has launched a website that is available worldwide. The casino offers a good selection of titles. All games are created by software developers who have made a name for themselves in the industry.

Besides bonuses, players can also take advantage of the VIP program. It may not look as interesting as other sites, but it is easy to browse the casino..

So you can easily identify everything without any obstacles. Casino operators have built casinos based on their many years of experience. Therefore, it brings an enjoyable experience to gamers.

Pros

Associated with top software providers

24/7 support team availability

Mobile friendly

Huge collection of games

Instant withdrawals for crypto users

Cryptocurrency is accepted along with fiat currency

Amazing bonuses

Cons

No video Poker section

(27) LetsLucky Casino

Special Bonus

1st deposit – 100% bonus up to $500 PLUS 100 free spins

2nd deposit – 100% match bonus up to $500 on top your money, PLUS 50 Free spins Bonus Code : LUCKY2

3rd deposit – 50% bonus up to $1,000 on top your deposit, PLUS 50 Free spins Bonus Code : LUCKY03

4th deposit – 25% bonus up to $2,000 + 100 Free spins Bonus Code : LUCKY4

Lets Lucky Casino is the place where your dream of getting into crypto gambling platform can come true. You can get the best gaming experience in a very relaxed mode. The casino always gives top priority to its players. The casino’s promo codes with bonuses are given high importance to all its players. The casino offers bonuses and gifts with fair bonus rules that will give you additional pleasure. The casino is available 24/7 and all the games here are developed by top best software providers. Take a deep breath and get into the world of Lets Lucky Casino.

Pros

Excellent Promo calendar

Multiple Crypto currency

Attractive design

Safety and Security

Wide range of payment options

Thousands of casino games

24/7 support team availability

Cons

Limited withdrawal methods

Only few crypto available

(28) Jozz Casino

Special Bonus

StartBonus :- Get up to 500$

The Azart Mania online casino, operating since 2012, has undergone a rebranding process, which changed its name to Jozz Casino. The Azartmania website was updated in July 2020. The new JOZZ Games Club operates under the license of Curacao and also offers a wide range of games – the official website of the online casino introduces more than 2000 certified slot machines, as well as an updated bonus system and loyalty program. Join the newly licensed. Jozz casino and get more chances to win.

Pros

High quality software providers

Reliability and safety

Attractive bonuses

Safe and Secure Payments

Mobile friendly

Cons

Restricted in many countries

(29) Jupi Casino

Special Bonus

Welcome Casino Bonus – 120% up to 600 EUR

Welcome Live Casino Bonus – 80% up to 400$/ EUR

Welcome Sports Bonus – 100% up to 100 EUR

Jupi Casino is a licensed online casino from Curacao that promises to take your Bitcoin gambling experience to the moon! They are a planet-themed online casino and sports betting site that puts players at the center of their attention, offering the most authentic interaction with current products and services. Jupi Casino offers players a more realistic online casino approach with a bright background combined with top online slots, tables and live casino games, and dealers with the most experience to serve you. With an easy-to-setup subscription, you get access to the most popular game providers.

Pros

Multi-Currency Account

Transparent transaction history

Lightning fast deposits & withdrawals

Complete privacy & security

Huge collection of games

Cons

Live chat unavailable

Winnings are limited

Restricted in many countries

(30) Mond Casino

Special Bonus

1st Deposit Bonus : 100% up to €200 (code: MOND1)

2nd Deposit Bonus : 50% up to €400 (code: MOND2)

3rd Deposit Bonus : 100% up to €200 (code: MOND3)

Mond Casino was created by a team of experts in the iGaming field. Their mission is to provide visitors with the ultimate iGaming destination that showcases the best aspects of the industry. They want players to have everything at once. There are about 4000+ titles for you to enjoy at peaks. This real money online casino has a straightforward interface available in multiple languages.

Pros

Easy-to-navigate interface

Highest safety and security standards

Industry-leading software providers

Top-quality online casino games

Excellent live dealer selection

Generous player perks.

Cons

Restricted in many countries

(31) Cobra Casino

Special Bonus

First Deposit Bonus : 100% bonus up to €500 + 250 Free Spins.

Second deposit bonus : 50% up to €150 + 50 free spins

Third deposit bonus : 125% up to €400

Sportsbook Welcome Bonus : 100% up to €100 in Free Bets + 50 Free Spins Bonus code: WSPORT.

First CRYPTO Deposit Bonus : 100% up to 1.5 BTC

Second CRYPTO Deposit Bonus : 50% up to 2.5 BTC + 50 free spins

Third CRYPTO Deposit Bonus : 125% up to 1 BTC

Cobra Casino is a new crypto casino and innovative online gambling site started in the year 2020. The casino is operated and owned by Dama N.V and registered under the laws of Curacao government. The casino offers more than 2000 games from top software providers. The casino is developed on high boosting technology which is used to play 4 different games at the same time. The casino is available in two different languages i.e., English and German.

Pros

Generous Welcome Package

Amazing Gaming Experience

2000+ Good Casino games

Tiered VIP Programme with weekly awards

Wide range of payments

Cons

Slow Withdrawals

No 24/7 withdrawals

(32) Stay Casino

Special Bonus

1st deposit – 100% bonus up to 500 EUR plus 100 FS

2nd deposit – 75% bonus up to 300 EUR plus 50 FS

3rd deposit – 75% bonus up to 500 EUR plus 50 FS

4th deposit – 50% bonus up to 700 EUR plus 50 FS

5th deposit – 100% bonus up to 1000 EUR

6th deposit – The secret bonus

StayCasino Online is licensed in 2021 – a year of great changes. The casino team has decided to distract you from boring reality, make you more comfortable, immerse yourself in the atmosphere of a real casino without leaving your room and help you win real money!

Grab your mobile or laptop, start playing and win real money! StayCasino offers over 8,000 games to everyone with an impressive win rate. Each game guarantees gifts and positive emotions.

Pros

Associated with top software providers

Safe and Secure Withdrawals

Exciting and thrill games

8000 + casino games

24/7 support team availability

Amazing Bonuses

Cons

Slow Withdrawals

One withdrawal per day

(33) SpinsBro

Special Bonus

First Deposit Bonus : 115% up to €300 + 100 FS in the Sugar Rush slot

Second Deposit Bonus : 75% up to €400 + 75 FS in the Sweet Bonanza slot

Third Deposit Bonus : 50% up to €500 + 50 FS in Sweet Bonanza

Fourth Deposit Bonus : 100% up to €300 + 125 FS in Gates of Olympus

Fifth Deposit Bonus : 500 FS (Book of Dead slot)

Sixth Deposit Bonus : 150% up to €500 + 150 FS in Moon Princess 100

The SpinsBro brand is new but is extremely attractive to all progressive players thanks to its vivid brand values

Focus on fairness, security and global development Giving players exactly what they want and need in terms of games, banking and promotional opportunities available 24/7 and 360 degrees open to players, that is their core value. trademark.

SpinsBro is a trademark of Altacore N.V., operating under the Curacao license. It supports about 200 countries, more than 10 languages and the same large number of fiat currencies and cryptocurrencies.

Pros

7,000+ games from nearly 100 gambling providers

20+ deposit & withdrawal methods with fair and transparent limits

Low wagering conditions

A large number of rewards, remunerations, and bonuses

Attractive, easy, and well-structured interface

Official Curacao license

Professional support team

96%+ average RTP of all games collectively

Super fast registration

VIP and loyalty programs boost the gaming experience of everyone.

Cons

Limited Payment options

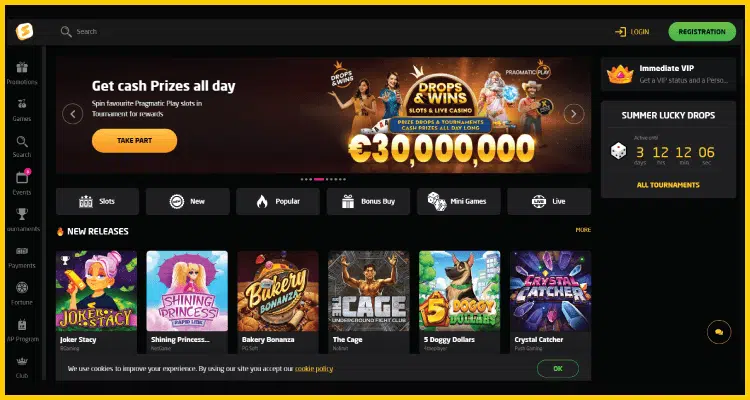

(34) Campeonbet

Special Bonus

Welcome Bonus : 140% up to $/€1500 bonus

Campeonbet is an online gaming site that provides a complete sports betting solution to the global betting community. The casino is operated by CW Marketing B.V, a company registered in Curacao. The Campeonbet team consists of iGaming professionals who are highly skilled and have previously worked with UK based operators to bring high quality game experience.

They insist on an open, honest and fair relationship between us, their customers and business partners. With live chat and customer support their friendly and well-trained staff will ensure that all All inquiries were answered efficiently.

Pros

Multi-currency Accounts

Transparent Transaction

History Lightning

Fast Deposits and Withdrawals

Complete Privacy and Security

Attractive Bonuses

Cons

Limited withdrawal options

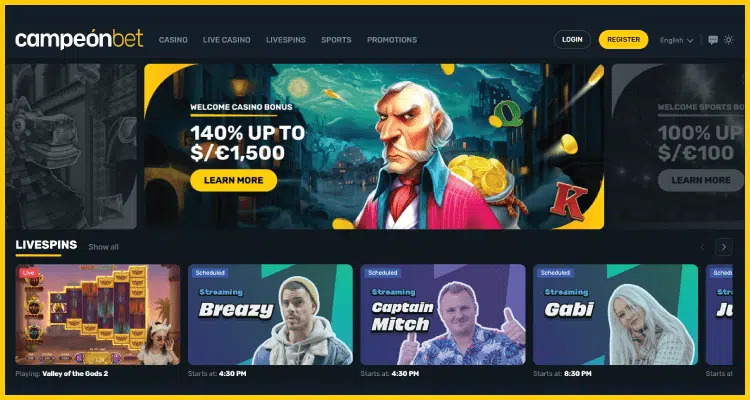

(35) Empire.io

Special Bonus

Welcome Bonus : Get a 10% boost up to 5000 USDT.

Empire.io is owned and operated by Echo Entertainment NV, which also holds a license from the Curacao authorities to operate an online gaming website. The site also offers an exceptional design, best customer support and VIP program for players. In addition, you can benefit from attractive bonuses and promotions to increase your income. Another important advantage of this operator is that the casino is accessible on all modern devices.

Pros

3000+ online casino games

Simple registration

Mobile Friendly

Fast Deposits and Withdrawals

Complete Privacy and Security

Boosting Bonuses

Cons

Live chat option is not available for unregistered players

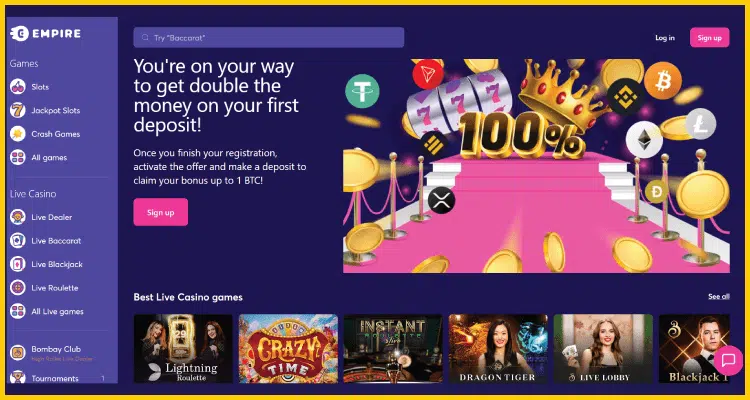

(36) Justbit

Special Bonus

Welcome Bonus : 45% cashback plus 30 Free Spin

Justbit.io is the newest online casino where you can play really exciting online casino games for real money. Because it’s newly formed (in 2021), their team is still working on different aspects of the casino, but it’s great nonetheless. Justbit.io and related rights belong to Casbit Group N.V. incorporated in Curaçao.

This crypto-friendly casino has a dark theme, which they have seen consistently over the past few months. As the name suggests, it focuses on crypto gambling.

This crypto-friendly casino has a dark theme, which they have seen consistently over the past few months. As the name suggests, it focuses on crypto gambling.

Pros

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

Amazing Bonuses

Simple registration

Mobile Friendly

Top quality games

Cons

Restricted in many countries

(37) Wild Tornado Casino

Special Bonus

Welcome Bonus : 300% UP TO €1000

Wild Tornado Casino is crypto online casino offers the best and amazing offers to all the new and experienced players. The casino is operated and owned by Dama N.V and registered under the laws of Curacao government. The casino always comes up with new features and new offers exclusively for all the gamers. Try all the benefits as a gamer. Register now!

Pros

Packed with 6000+ hot games

Best Bitcoin Casinos Online

24/7 support team availability

Fully licensed and secure

Immense choices to offer

Mobile Friendly

Welcome offer up to 1000 EUR.

Cons

Restricted in many countries

(38) Grand Theft Casino

Special Bonus

First Deposit Bonus : 100% UP TO 200 EUR

Second Deposit Bonus : 20% UP TO 2500 EUR

Third Deposit Bonus : 20% UP TO 2500 EUR

Grand Theft Casino’s mission is to create a quality casino that they can be proud of, providing players with the best gaming experience possible. Their services are something they like to experience for themselves and they are happy to offer a wide range of online casino games from the top providers, a friendly customer support team, outstanding tournaments and quick withdrawals.

Casino is operated by JoyWinner Interactive Ltd. Each of the more than 4000 games available on their site has been provided by a trusted game provider. At the Casino, the casino accepts a variety of currencies to make it easy for you to play your favorite games. A wide range of secure payment methods designed to make your experience as comfortable as possible.

Pros

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

4000+ casino games

Most trusted online casino

Mobile Friendly

Wide range of payment options

Cons

Restricted in many countries

(39) Black Lion Casino

Special Bonus

First deposit: Use code 100LION to get a 100% bonus up to 200€ and 20 free spins on the Lucky Lions Wild Life.

Second deposit: Use code 50LION to get a 50% bonus up to 400€ and 40 free spins on Lucky Lions Wild Life.

Third deposit: Use code L100N to get a 120% bonus up to 400€ and 25 free spins on the Lucky Lions Wild Life.

First Crypto Bonus : 150% bonus up to 300 EUR. Use code LION150

Black Lion Casino offers you a wide selection of online gambling products such as several live casinos and several casino games in a friendly gaming environment. At Black Lion Casino, you are more than just a customer and they will always do their best to accommodate your individual needs and desires. Their friendly support team is available by email, live chat and phone.

www.blacklioncasino.com also offers a new and improved one-stop wallet solution that allows you to seamlessly transfer your funds on the site without having to make a transaction as you change your game on the site. Black Lion Casino holds a gaming license in Curacao. All customer data is encrypted and protected by VeriSign SSL – Secure Sockets Layer.

Pros

Attractive casino design

The Bonuses are wager free

24/7 support team availability

Simple registration

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

Wide range of payment options

Mobile Friendly

Top quality games

Cons

Restricted in many countries

Limited withdrawals

(40) Shambala Casino

Special Bonus

First Deposit Bonus : 100% up to ₹8500 + 180 Free Spins

Second Deposit Bonus : 50% up to ₹8500

Third Deposit Bonus : 50% up to ₹17000

Fourth Deposit Bonus : 100% up to ₹8500

Shambala has all the bulk casino products like slots, roulette, live casino, blackjack, bingo, craps. Their collection of crypto games is huge and growing. It was founded by a group of casino enthusiasts with a clear goal in mind. They love what they do and follow their motto of first come, first served. Everyone deserves a supportive experience. Their knowledgeable support managers are happy to assist you via live chat or email.

Only provides a fair and protective online gaming environment. All games are RNGs certified to provide true and random results. Shambhala operates under license from the Curacao Gaming Authority. Enjoy your gaming activities secured by license and certified RNG results.

Pros

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

5000+ casino games

Certified and Licensed casino

Mobile Friendly

Fast Payouts

Cons

Restricted in many countries

(41) Thor Casino

Special Bonus

First Deposit Bonus : 100% bonus up to 200€ + receive extra 25 Free Spins on slot Thor Hammer Time. Use code THOR1

Second Deposit Bonus : 50% up to 400€ + 50 Free Spins on slot Thor Hammer Time (code: THOR2)

Third Deposit Bonus : 25% up to 800€ + 50 Free Spins on slot Thor Hammer Time (code: THOR3)

Fourth Deposit Bonus : 50% up to 400€ + 50 Free Spins on slot Thor Hammer Time (code: THOR4)

Fifth Deposit Bonus : 100% up to 200€ + 25 Free Spins on slot Thor Hammer Time (code: THOR5)

Thor Casino, they provide their players with the best licensed casino experience. They offer over 5000 slot games from the best slots providers in the world, great bonuses, no-bet promotions and a VIP club. The Casino is the safest real money online casino, where players can enjoy their favorite games without any worries. In addition to their world-class casino service, they also offer the highest level of security to all players. Safety, security and fairness are the foundation of their business. This is what sets us apart from other iGaming sites that do not prioritize player protection and safety.

Pros

Fully Licensed Online Casino

Over 5,000 Games

Fast Verification

Instant Withdrawals

Top Bonuses and Promotions

Instant Deposits and Withdrawals

Mobile friendly

Crypto Casino USA

VIP Club

24/7 Support

Cons

Limited withdrawals

(42) Art Casino

Special Bonus

First deposit bonus : 100% bonus up to €1,000

Art Casino is one of the leading online casinos in the world, offering a wide range of games and services to players. Furthermore, he has built a solid reputation in the industry. In addition, this casino is licensed by the Curacao Gaming Authority, which ensures that it operates in a safe and fair environment. In addition, the casino offers a wide range of slots, table games and live dealer games from leading software providers .

The casino also offers a sports betting platform and a poker room, giving players a wide range of options. With a user-friendly interface and excellent customer support, this casino is perfect for experienced players as well as beginners.

Pros

Associated with top software providers

24/7 support team availability

6000+ casino games

Certified and Licensed casino

Mobile Friendly

Fast Payouts

Cons

Restricted in many countries

(43) Vavada

Special Bonus

Welcome Bonus : 100% bonus up to €1,000 plus 100 Free Spins.

Vavada is a 2017 online casino where you can spend your free time and enjoy a huge library of over 4000 different products. They include a wide selection of the most popular and recently released slot games as well as various table and card games in virtual and live formats. The site is widely available internationally, so of course the selection of supported payment methods is excellent.

Pros

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

Certified and Licensed casino

Mobile Friendly

Fast Payouts

Cons

Restricted in many countries

Week Weekend withdrawals

Processing fees for Withdrawals

(44) Lucky Block

Special Bonus

Welcome Bonus : 200% Bonus up to 10,000 EUR + 50 Free Spins

Lucky Block is an online crypto casino launched in 2022. This casino specializes in cryptocurrencies – in fact, you can only use crypto for deposits and withdrawals. There are countless games to choose from, including slots and live dealer games. They’re powered by over 15 top developers, meaning you’ll always be in safe hands no matter what game you choose to play. Sports betting also offers a wide variety of options and to match the casino’s progressive approach, there are also different eSports betting markets.

Pros

Associated with top software providers

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

1000+ Slots

Impressive Sports Betting

Mobile Friendly

Fast Payouts

Cons

Restricted in many countries

Limited Games in Betting

(45) Meta Spins

Special Bonus

Welcome Bonus : 100% bonus up to 1 BTC

Metaspins is an official crypto casino that goes beyond what others have to offer. With full Web3 integration, at Metaspins.com you can deposit, withdraw and buy cryptocurrencies with ease anywhere in the world. But don’t stop there: in the near future, Metaspins.com will include Web3 features such as NFT market launch. Players will be able to play their favorite casino games using any NFT they own, including those designed by Metaspins; all they have to do is link the Web3 Ethereum wallet to their account on Metaspins.com. It’s a very simple process, especially thanks to the Metamask integration.

Pros

Associated with top software providers

Weekly Tournaments

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

Mobile Friendly

Fast Payouts

Cons

Restricted in many countries

(46) Wild.io

Special Bonus

Welcome Bonus : 10 BTC Boost your deposits with over 625% in Bonuses and 1400 Free Spins!

Wild.io is a crypto thrills casino designed for fun loving players. Here you will find the most innovative way to play crypto online, designed by crypto lovers who like to bet online.

Pros

24/7 Stellar Live Chat Support

Weekly Tournaments with thousands of free spins and cash prizes

privacy & anonymity

fast deposits & withdrawals

Provably fair games

Multi-currency

3,000+ games

Cons

Does not support fiat currency

(47) Vave Casino

Special Bonus

Welcome Bonus : 100% cashback up to 1 BTC.

Welcome Sports Bonus : 100% cashback up to 1 BTC.

Vave is one of the emerging crypto casino and sports betting sites that make cryptocurrency trading in online casinos easier and more enjoyable for players of all walks of life. They have over 3000 games on their site for players to choose from and they can even bet on live sports games.

Pros

Wide varieties of Payment

Associated with top software providers

Simple Registration

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

Mobile Friendly

Cons

Restricted in many countries

Live Chat unavailable

Not popular as it is new

(48) Bitreels

Special Bonus

Welcome Offer: Get 3500 €/$ plus 350 Free Spins

Bitreels.com is the brainchild of a group of friends who are also casino enthusiasts and iGaming industry veterans. The casino goal is to use their passion and experience to create a truly enhanced casino experience by completely changing the game!

BitReels.com is at the forefront of innovative, transparent and fair online gaming. They’ve worked hard to create a smart, player-centric interface that lets you enjoy a great online gaming experience.

Pros

Wide varieties of Payment

Associated with top software providers

6500+ games

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

Mobile Friendly

Cons

Restricted in many countries

Strict Bonus rules

(49) Sol Casino

Special Bonus

Welcome Offer: Get 50 Free Spins

Solcasino.io is one of the Top Crypto Casinos on Solana Network. The casino is one of the upcoming and promising blockchains and they are still in their infancy. With that in mind, Solana lacks a good casino where you can gamble using Solana based tokens.

This is how the first casino on the Solana blockchain was born: solcasino. You can enjoy live casino, casino, sports betting and much more.

Pros

User Friendly

Associated with top software providers

Simple Registration

24/7 support team availability

Mobile Friendly

Cons

Restricted in many countries

Limited Payments

(50) Wazamba

Special Bonus

Welcome Bonus : 100% bonus up to 500 EUR plus 200 FS plus 1 Bonus card.

Welcome Sports Bonus : Up to 100 EUR mBTC plus 100 FS plus 1 Bonus card.

Wazamba may not be the biggest name in the online casino world, but it offers much more than many established brands. When it comes to website design, Wazamba is one of the best to come across. Full of vibrant designs and icons, this is a website brimming with artistic flair and distinctive style.

This is not only a casino with a pretty face but a place of great quality. With more than 90 game providers at hand, You have endless options, allowing me to play all my favorite slots and table games. By playing slot machines, You can also accumulate more benefits here.

Pros

Associated with top software providers

Outstanding Bonuses

Cryptocurrency is accepted along with fiat currency

24/7 support team availability

Mobile Friendly

Fast Payouts

Cons

Restricted in many countries

(51) FairSpin

Special Bonus

First Deposit Bonus : 100% up to 30 FS

Second Deposit Bonus : 75% up to 30 FS

Third Deposit Bonus : 75% up to 30 FS

Fourth Deposit Bonus : 200% up to 50 FS

Founded in 2018, Fairspin online casino has opened its digital doors to online casino players and sports betting enthusiasts. It works according to TechCore B.V. with a valid license from the Curacao Gambling Commission . The main part of the business is to provide both fiat and crypto payment methods in modern crypto online casinos and provide a great gaming experience to players around the world.

Pros

- Licensed Games

- Cryptocurrency accepted along with fiat currency.

- Mobile Friendly

- Generous Bonuses and Promotions

- Responsive Gambling

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

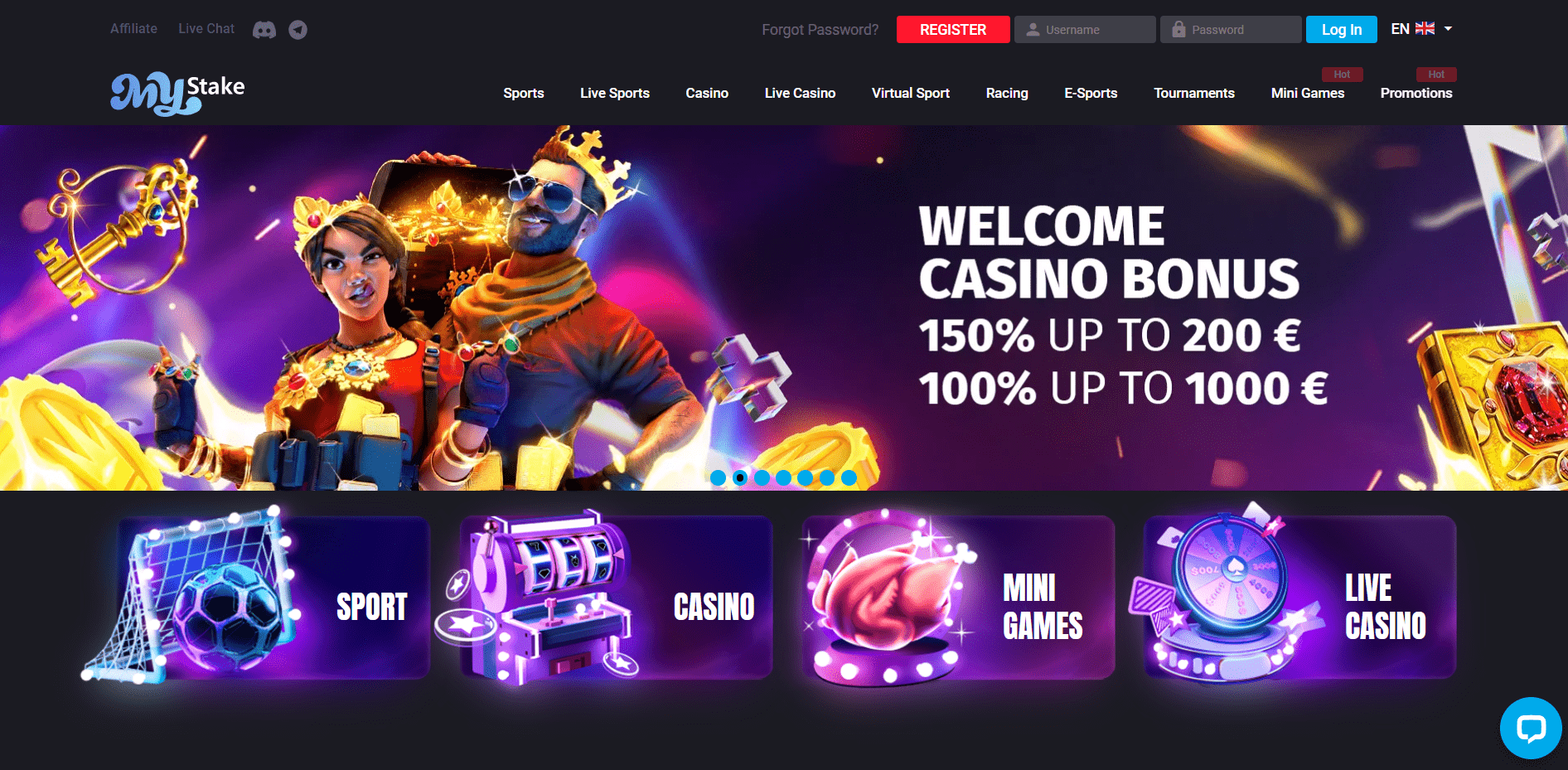

(52) MyStake

Special Bonus

Welcome Bonus : Deposits between 20€/$ and 200€/$ will be awarded a 150% bonus

Deposits between 201€/$ and 1000€/$ will be awarded a 100% bonus

Sports Bonus : 100% Bonus up to 500€/$

MyStake is one of the comprehensive online casino sites that you may want to join to fulfill all your betting needs. All the different sections of the site are very rich and it also offers crypto betting options. The MyStake esports, sports and casino sites are the main focus of the site and each has huge appeal. Add to that a wide selection of promotions and you have everything you need to enjoy long-term betting on MyStake.

Pros

- Secure Payments

- 24/7 Support team

- Mobile Friendly

- Multiple Currencies

- Highest Odds

- Generous Bonuses and Promotions

- Responsive Gambling

- Fast Payments

Cons

- No Regular promotions

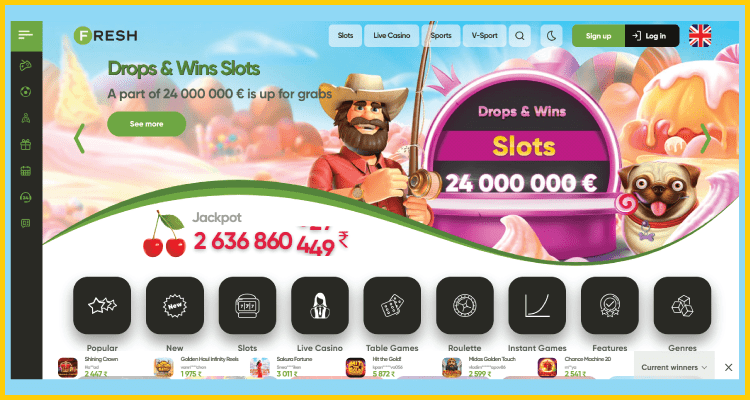

(53) Fresh Casino

Special Bonus

Welcome Bonus : Get 100% up to 600$

Fresh Casino is popular as an online gambling site, offering a large selection of games and quality customer service. Besides the typical variety of casino games, one of the most attractive features is the loyalty program, bonuses on deposits and regular games. Fresh Casino stands out as an ideal choice for anyone looking to try their luck while enjoying a gaming experience. reliable.

Pros

- Home for Top Software Providers

- Associated with top software providers

- 24/7 Support team

- Mobile Friendly

- Wide range of payments

Cons

- Limited Video poker section

- Limited Withdrawal limit

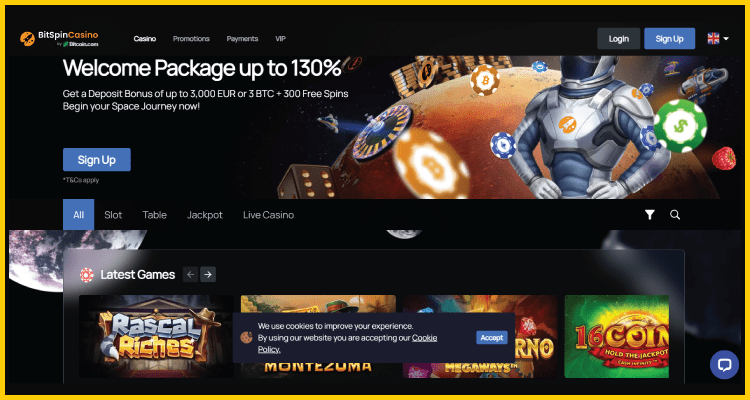

(54) BitSpinCasino

Special Bonus

First Deposit Bonus : Get a 120% deposit bonus on your first deposit and 300 Free Spins

Second Deposit Bonus : Get 80% Deposit Bonus

Third Deposit Bonus : Get 80% Deposit Bonus

BitSpinCasino is a dynamic and powerful gaming platform brought to you by some of the most seasoned professionals in the casino industry. They always strive to facilitate a gaming platform that not only presents the best features in its segment, but is also transparent and secure. You are assured that you are playing with one of the most trusted online casinos where the safety of your money is their top priority.

Pros

- Multiple Currencies

- Fast Transactions and Payouts

- Cryptocurrency accepted

- Mobile Friendly

- Generous Bonuses and Promotions

- Home for Top Software Providers

- 24/7 Support team

Cons

- Restricted in more number of countries

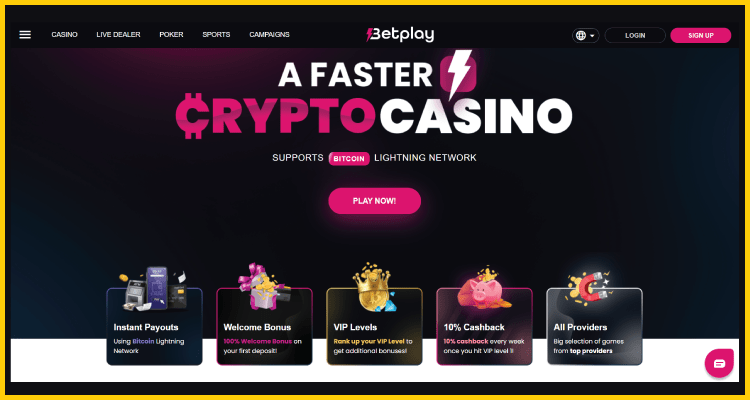

(55) Betplay.io

Special Bonus

Welcome Bonus : Get a 100% bonus on your first deposit with a total reward of up to 50,000 micro-bitcoins.

Betplay Casino was first launched in 2020. Since then, it has offered its users a wide range of casino games, including slots, live games, poker and table games. The online casino operator was able to attract a large number of players to the iGaming market because it accepts Bitcoin deposits. So you can easily deposit and withdraw from your Betplay account with this cryptocurrency. For the safety of its players, Betplay Casino is licensed and regulated by the Curacao Gambling Commission. In addition, the online casino also uses the latest encryption software on all of its gaming platforms.

Pros

- Instant deposit with zero virtual fees

- Cryptocurrency accepted along with fiat currency.

- Cash Out within Seconds

- Mobile Friendly

- Generous Bonuses and Promotions

- Responsive Gambling

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

(56) Weiss.bet

Special Bonus

First Deposit Bonus : 100% up to 30 FS

Second Deposit Bonus : 75% up to 30 FS

Third Deposit Bonus : 75% up to 30 FS

Fourth Deposit Bonus : 200% up to 50 FS

Weiss.bet Casino, a great gaming paradise that has been exciting players since its inception! Founded by Taktonum Group N.V. Famously, this casino has it all – from a wide range of game categories to exceptional customer support. At Weiss.bet Casino, you have thrilling offers with a wide selection of live casino games. And if that wasn’t enough, Weiss.bet casino also offers sportsbooks to all sports fans. This casino has a knack for keeping things interesting, offering a ton of great promotions, tournaments and VIP/loyalty programs to reward the most dedicated players.

Pros

- Cryptocurrency accepted along with fiat currency.

- Fabulous VIP Program

- Mobile Friendly

- Generous Bonuses and Promotions

- Wide range of games

- User Friendly

- 24/7 Support team

Cons

- Processing Fees may apply

- Withdrawals limits

(57) BSpin

Special Bonus

Welcome Bonus : 100% fair bonus up to 1,000,000 μBTC + 20 free spins

Founded in 2018, Bspin.io has built a solid reputation over the past 5 years and brings together industry gurus who have been there for almost two decades.

The casino is operated and owned by Meta Gaming NV. The company is well licensed by the Government of Curacao , The team behind it believes that the future of gaming is cryptocurrency. Therefore, they chose Bitcoin, the king of cryptocurrency to develop their website and provide services on a global scale.

They describe their online casino as a proprietary Best Bitcoin casino platform and promise to deliver the best experience available today.

Pros

- Mobile Friendly

- Generous Bonuses and Promotions

- Responsive Gambling

- Provably Fair Games

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

(58) BigWins

Special Bonus

Welcome Bonus : 100% bonus up to 250 USDT

Welcome to the best place for players around the world, BigWins Crypto Casino. This is not only a game website developed by game industry veterans, but also a state of the art. Well, here you will find the best crypto and best bitcoin online casino games in the world. However, beyond that, you will find opportunities. Here you have an opportunity to dream big, play big and win big when things go your way.

It is an entertainment center where you can play games, adopt the latest payment technologies and open doors. In addition to the games, you will receive daily cashback bonuses and promotions that will get you something even if luck is not on your side.

Pros

- Massive collection of games

- Cryptocurrency accepted

- Live casino games

- Simple crypto deposits

- Mobile Friendly

- Generous Bonuses and Promotions

- Responsive Gambling

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

- Accepts only Crypto

(59) Boho Casino

Special Bonus

First Deposit Bonus : 100% up to €500 + 100 Free Spins

Second Deposit Bonus : 50% up to €1000 + 50 Free Spins

Third Deposit Bonus : 75% up to €500 + 75 Free Spins

Boho casino is operated by Hollycorn N.V., it is a brand new online platform created in 2022. The casino is considered the leading and responsible gaming environment for professionals and enthusiasts alike. this field. Licensed by Curaçao eGaming, it represents a legal and safe online site.

Boho Casino offers a game library, attractive bonuses and very secure payouts which continue to attract new players to the site.

Pros

- Mobile Friendly

- Generous Bonuses and Promotions

- Responsive Gambling

- Provably Fair Games

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

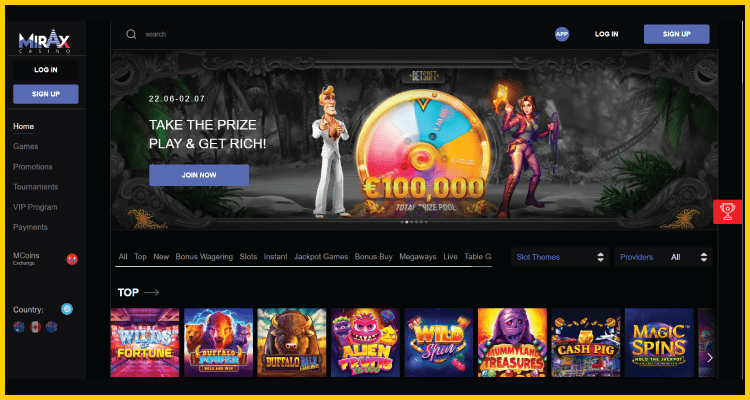

(60) Mirax Casino

Special Bonus

First Deposit Bonus : 100% up to 1.5 BTC + 50 FS

Second Deposit Bonus : 50% up to 1 BTC + 50 FS

Third Deposit Bonus : 75% up to 1 BTC + 50 FS

Fourth Deposit Bonus : 100% up to 1.5 BTC

Welcome to Mirax Kingdom! The future of BTC gambling is here. In their French Bitcoin Mirax casino, players can experience their superpowers. Almighty Poison! Fire-breathing potion!Eternal happiness and more! Reach top 10 level in their Mirax casino VIP club and get Time flow potion.

Pros

- 7000+ exciting casino games

- Fast payouts with crypto

- Outstanding promotions with tournaments

- Security and transparency

- Outstanding Loyalty

- Licensed Casino

Cons

- Restricted in more number of countries

- Processing Fees applied

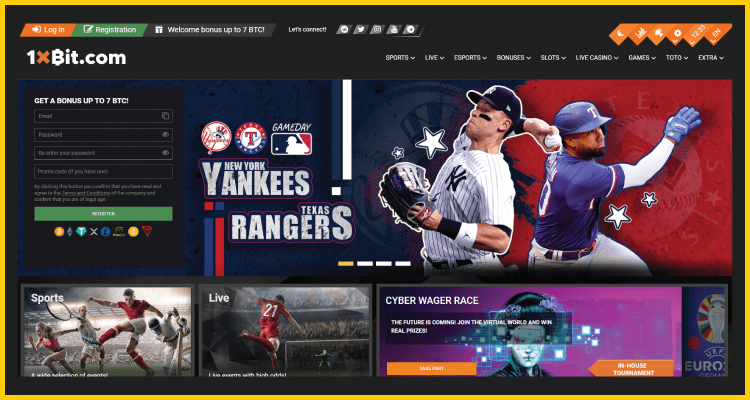

(61) 1xBit Casino

Special Bonus

Welcome Bonus : New players and get a bonus up to 7 BTС!

1xBit is a crypto online casino and a leading provider in this relatively new industry. It supports almost 21 different cryptocurrencies and offers a wide selection of games. But this site is mainly focused on sports betting and online games make up a small part. The main theme colors of the casino are black, orange and white and the graphics are of a very high quality.

1xBit Game is developed by more than 100 leading software providers in the industry.The site has different versions for PC and mobile. There are many offers and 1xBit bonus offers to attract amateur and expert players to come back for more.

Pros

- Easy registration process

- Instant no-fee deposits and withdrawals

- The most competitive odds and wagering options

- Live bets for most sport events

- ONLINE poker

- Top casino games

- Lots of rewards and bonuses

Cons

- Only Crypto is supported

- Not User Friendly

- Free Spins are not available

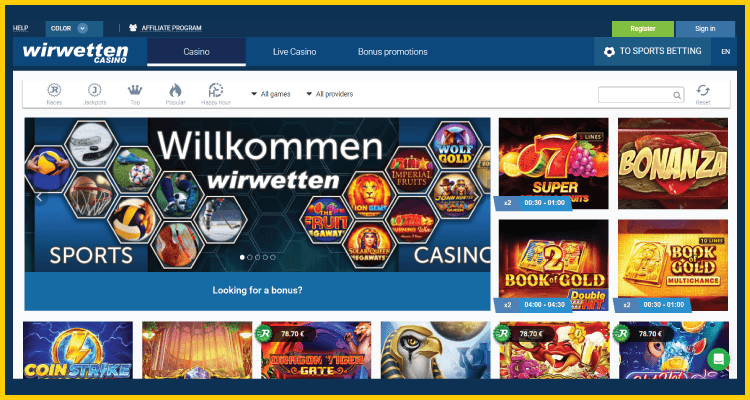

(62) Wir Wetten Casino

Special Bonus

Casino Welcome Bonus : 100% deposit bonus plus 40 Free Spins. Use Code WELCOME300

Sports Welcome Bonus : 100% deposit bonus plus 40 Free Spins. Use Code WELCOME100

Wir Wetten Casino is one of the leading online casinos where players can enjoy hundreds of casino games from a top software supplier . This online casino can be operated on any electronic device through a browser. Players can have access to many top software providers. Wir Wetten Casino is licensed by the Alderney Gambling Control Commission.

Pros

- Mobile Friendly

- Generous Bonuses and Promotions

- Responsive Gambling

- Provably Fair Games

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

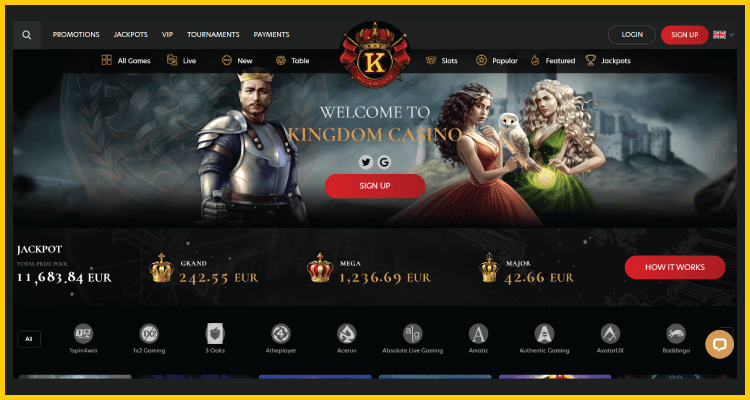

(63) kingdom casino

Special Bonus

First Deposit Bonus : 100% up to 200 EUR + 25 free spins

Second Deposit Bonus : 75% up to 200 EUR + 25 free spins

Third Deposit Bonus : 120% up to 200 EUR + 50 free spins

At Kingdom Casino, they strive to provide the most enjoyable online casino gaming experience.

Kingdom Casino is a world-renowned comprehensive gaming experience. They offer a wide range of casino games with exceptional customer service as well as some great bonus bonuses.

Kingdom Casino is part of the Softswiss online casino group, one of the most trusted, long-standing and well-known brands in the online gaming industry.

Kingdom Casino is a fully licensed and regulated online casino.Therefore, they strongly support responsible gambling in compliance with applicable laws.

Pros

- Mobile Friendly

- Generous Bonuses and Promotions

- Amazing Games

- Earn rewards as you play

- Safety is their top priority

- Fast Payments

- 24/7 Support team

Cons

- Restricted in more number of countries

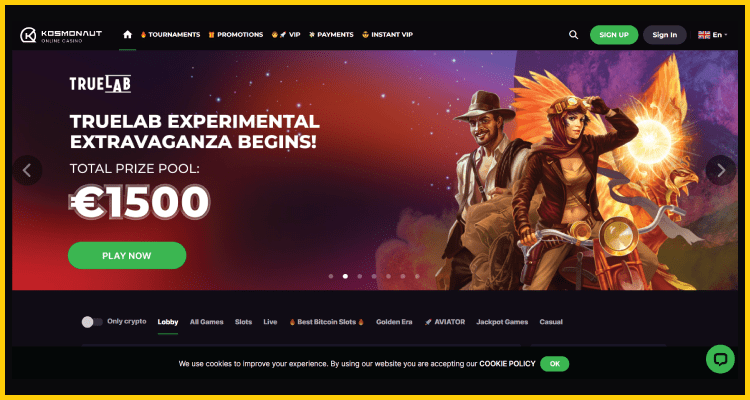

(64) Kosmonaut Casino

Special Bonus

First Deposit Bonus : 100% + 50 FS Bonus up to €/$500 CODE: KOSMO1

Second Deposit Bonus : 75% + 75 FS Bonus up to €/$200 CODE: KOSMO2

Third Deposit Bonus : 100% + 25 FS Bonus up to €/$300 CODE: KOSMO3

Kosmonaut Casino immerses you in an intergalactic gaming experience with breathtaking promotions, incredible tournaments and the best online casino games. Crypto-enabled casinos offer an impressive range of promotions, including generous no-stakes bonuses. The space-themed Game Center has a sleek and sophisticated look that immerses you in the game experience. The site is designed to be easy to use, with easy-to-access menus and easy navigation. Although the site is themed; The focus is all on the content of the game. Plus, the casino has a great mobile casino, so you can pocket the fun and enjoy it wherever you are.

Pros

- Mobile Friendly

- Safe and Secure Payments

- Amazing Games

- Earn rewards as you play

- Safety is their top priority

- Accepts Cryptocurrency

- 24/7 Support team

Cons

- Restricted in more number of countries

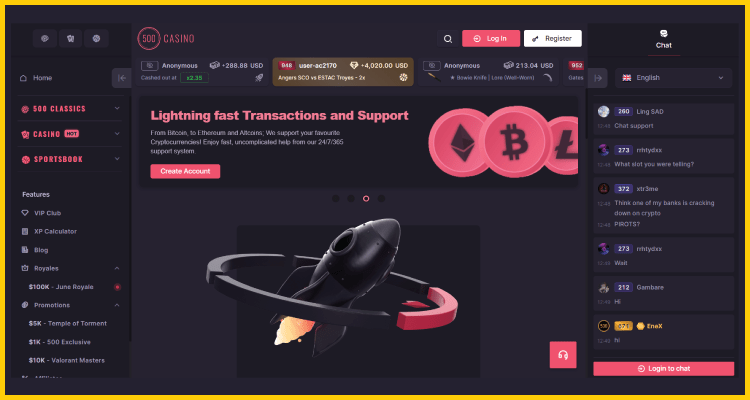

(65) 500 Casino

Special Bonus

Welcome Package : Bonus Up to $1000 and 50 FS for your first deposit

500 Casino, also known as CSGO500, is a licensed online platform for CS:GO and crypto games that offers a wide range of games. It was launched in 2016 and it has become one of the top gambling destinations for skin gaming.

In recent years, the site has been renamed 500 Casino and expanded to include a variety of casino games from a variety of providers, including slot machines. In addition to a large selection of games, 500 Casino is also well known as a reliable and trustworthy platform for online gambling.

Pros

- Easy registration

- Great selection of games

- Daily free bonuses

- Large selection of deposit and withdrawal methods

- Live on-site chat

Cons

- Restricted in more number of countries

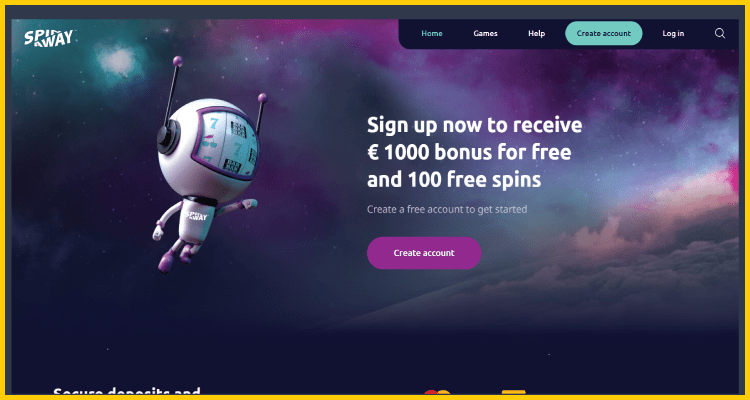

(66) SpinAway Casino

Special Bonus

First Deposit Bonus : 100% bonus up to € 100 plus 100 FS

Second Deposit Bonus : 50% bonus up to € 200

Third Deposit Bonus : 25% bonus up to € 700

Welcome to SpinAway Casino, a modern and exciting space themed online gaming platform just launched. The casino has a Curacao eGaming license and is operated by NGame Group, so bettors are always guaranteed to be safe and fair. SpinAway Casino offers a wide range of secure and reliable payment options for fast payouts and efficient, hassle-free transactions.

.

Pros

- Easy registration

- 1400+ games

- Daily free bonuses

- cryptocurrency with fiat currency is accepted

- Safe and Secure

- Fast withdrawals

Cons

- Restricted in more number of countries

- Limited Withdrawals

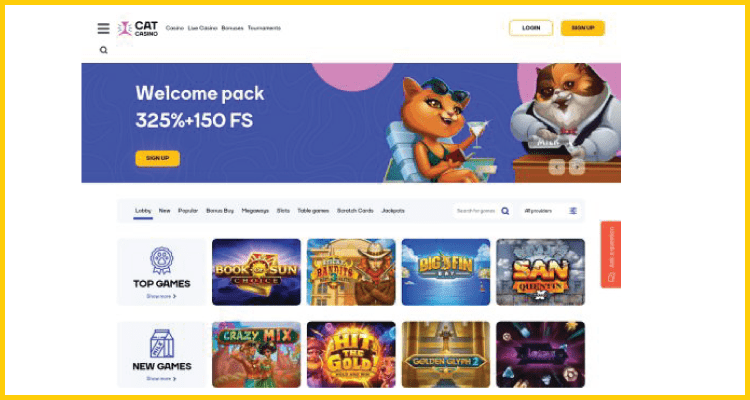

(67) Cat Casino

Special Bonus

Welcome bonus: 325% + 150FS

Launching in 2021, Cat is one of the newest additions to the endless sea of online casinos, which includes a huge library of over 3000 different games. Its website features a simple, cartoonish design with a simple template, a large interactive banner that features promotions and a game catalog as the focus. So, go ahead and describe the advantages and disadvantages of a casino and decide if it is a safe place to gamble.

Pros

- Associated with top software providers

- Safe and Secure platform

- Cryptocurrency with fiat currency is accepted

- Mobile-friendly.

- 24/7 Support team availability

- Huge collection of games

Cons

- Restricted in more number of countries

- Limited Withdrawals

(68) Kakadu Casino

Special Bonus

First Deposit Bonus : 100% up to 200 EUR + 100 FS

Second Deposit Bonus : 50% up to 100 EUR

Third Deposit Bonus : 75% up to 100 EUR

Fourth Deposit Bonus : 50% up to 100 EUR plus 50 Fs

Kakadu Casino is a group of innovative individuals with many years of experience in the online casino and gaming industry. They experience all the latest casino developments, constantly dialogue and understand the casino world about its complexity and its high-end and thrilling entertainment demands. The main goal is to satisfy their players and casino partners, combine their vision with the best solutions and touch the hearts of the casino universe.

They ensure fair play and honest play, and are also aware of their responsibilities to their players and society. They continuously monitor and verify their games to prevent crashes and avoid abuse by minors.

Pros

- Trusted Casino licenced

- Easy and fast withdrawals

- 24/7 Support team availability

- Wide range of payment

- Weekly Promotions and Extra bonuses for regular

Cons

- Restricted in more number of countries

(69) Arcanebet Casino

Special Bonus

Welcome Bonus : 100% up to €200 plus 50 free spins

At ArcaneBet.com casino,you can play slots, jackpots and table games from the major providers. ArcaneBet is a sleek and easy-to-use online casino founded in 2020. This online casino is operated under the Curacao eGaming license, they offer a variety of payment methods including cryptocurrencies.

Pros

- Fast Verification and Withdrawals

- Generous Bonuses and Promotions

- 3000+ online casino games

- Safe and Secure platform

- Mobile Friendly

Cons

- Limited Live Chat

- Restricted in more number of countries

(70) Aplay Casino

Special Bonus

Welcome Bonus : 100% up to €500 plus 50 free spins

APlay is an online casino licensed by the Maltese. This casino site was founded in 2017. And yes, you can get offers on APlay. Check for valid casino offers in the bonuses section.

This particular casino site has 47 game providers covering game genres like Blackjack, Roulette, Video Poker, Baccarat, Craps, Scratchcard, Keno and Sportsbook. This casino is owned by a company called Avento N.V. This company is registered in Curacao, which means it operates under the Curacao gambling license.

Pros

- Wide range of payments

- Sportsbook

- Excellent collection of games

- Safe and Secure platform

- Mobile Friendly

Cons

- Restricted in more number of countries

(71) IceBet Casino

Special Bonus

Welcome Bonus: 275% up to €1200 plus 275 free spins.

Icebet Casino is a new casino in the gambling market, established in 2021. Altacore NV operates the casino platform, which has a user-friendly interface. The white background has graphic elements and colorful characters that are sure to catch the attention of the viewers. Players can easily go to the game lobby as Icebet offers both a navigation bar and a search bar.

Pros

- Associated with the top best software providers

- Wide range of payments

- Many amazing Bones and Promotions

- Mobile Friendly

- 24/7 Support team availability

- Cryptocurrency with fiat currency is accepted

Cons

- Limited Withdrawals

- Restricted in many countries

(72) Slotman Casino

Special Bonus

First Deposit Bonus : 100% UP TO 800 EUR + 60 FREE SPINS

Second Deposit Bonus : 75% UP TO 1000 EUR + 50 FREE SPINS

Third Deposit Bonus : 50% UP TO 1700 EUR + 40 FREE SPINS

Slotman is a casino that was launched in 2020 and since then it has grown at breakneck speed. As the name suggests, this is a Superman-inspired casino and you should only expect Superman-worthy bonuses and games. Over the years, the casino has added more games to its catalog, diversified its bonus offers and added a wide range of payment methods.

Pros

- Associated with the top best software providers

- Wide range of payments

- Many amazing Bones and Promotions

- Mobile Friendly

- 24/7 Support team availability

- Cryptocurrency with fiat currency is accepted

Cons

- Restricted in many countries

(73) Everum Casino

Special Bonus

Welcome Bonus: 100% up to €100 with bonus code “WELCOME”

Everum Casino is a modern online casino, created to provide players with easy and convenient access to games from top providers.

Everum N.V. was licensed in Curacao, Netherlands Antilles. The casino software and infrastructure is designed to secure your data and ensure you the highest level of security. All your information is kept confidential and private, and they will not share or sell your data to third parties.

Pros

- Associated with the top best software providers

- High Withdrawals

- Wide range of payments

- Many amazing Bones and Promotions

- Mobile Friendly

- 24/7 Support team availability

Cons

- Restricted in many countries

- Processing fees for all the transactions

(74) Ignition Casino

Special Bonus

Welcome Bonus: Get 100% up to 3000$ bonus.

Ignition Casino is a great choice if you are looking to try out a new casino with a wide selection of games. With over 300 games to choose from, including an extensive collection of slots, table games, video poker, live dealer games, virtual poker and sports betting , Ignition promises a great gaming experience for players of all levels.

Pros

- Associated with the top best software providers

- Wide range of payments

- Virtual Sports

- Many amazing Bones and Promotions

- 300+ casino games

- Mobile Friendly

- 24/7 Support team availability

Cons

- Restricted in many countries

(75) Jackbit

JackBit is one of the best crypto casinos that has a large game library and an extensive bookmaker. This is an exciting new casino that has a nice and modern design, with neon icons and cryptocurrency logos floating in the background.

You can’t say that JackBit just launched in 2022, because this online casino has a huge set of online games. Sportsbooks are also pretty awesome, especially the eSports collection that includes more eSports competitions than most online sportsbooks.

JackBit is operated by Ryker BV and holds a Curacao gaming license and an eGaming license.

Pros

- Associated with the top best software providers

- Wide range of payments

- Virtual Sports

- Many amazing Bones and Promotions

- 6500+ casino games

- Mobile Friendly

- 24/7 Support team availability

Cons

- Restricted in many countries

(76) SuperSlots

Special Bonus

First Deposit :- 250% bonus up to $1,000 use code SS250

Next Five Deposits :- 100% bonus up to $1,000 use code SS100

Super Slots offers a unique collection of more than 500 casino games from best software providers. These great games are combined with attractive bonuses and convenient crypto payment options which of course make Super Slots one of the best online casinos.

Pros

- Associated with the top best software providers

- Wide range of payments

- Mobile Friendly Games

- Numerous Bonuses

- 24/7 Support team availability

Cons

- Restricted in many countries

- User interface has to improved